Turkiye Petrolleri, Turkey’s state-owned energy company, is preparing its inaugural international debt offering. The firm plans to sell up to $4 billion in Islamic debt, known as Sukuk. This significant financial move aims to bolster the company’s efforts to expand its oil and gas production capabilities.

Upcoming Sukuk Offering

Turkiye Petrolleri will issue Islamic debt instruments, or Sukuk, to raise capital. This offering represents a substantial financial undertaking for the state energy company. The target amount for the sale reaches as much as $4 billion.

First International Debt Sale

This planned Sukuk issuance marks a notable milestone for Turkiye Petrolleri. It constitutes the company’s first international debt offering of this specific type. Consequently, the offering will introduce Turkiye Petrolleri to a broader global investor base.

Expanding Energy Production

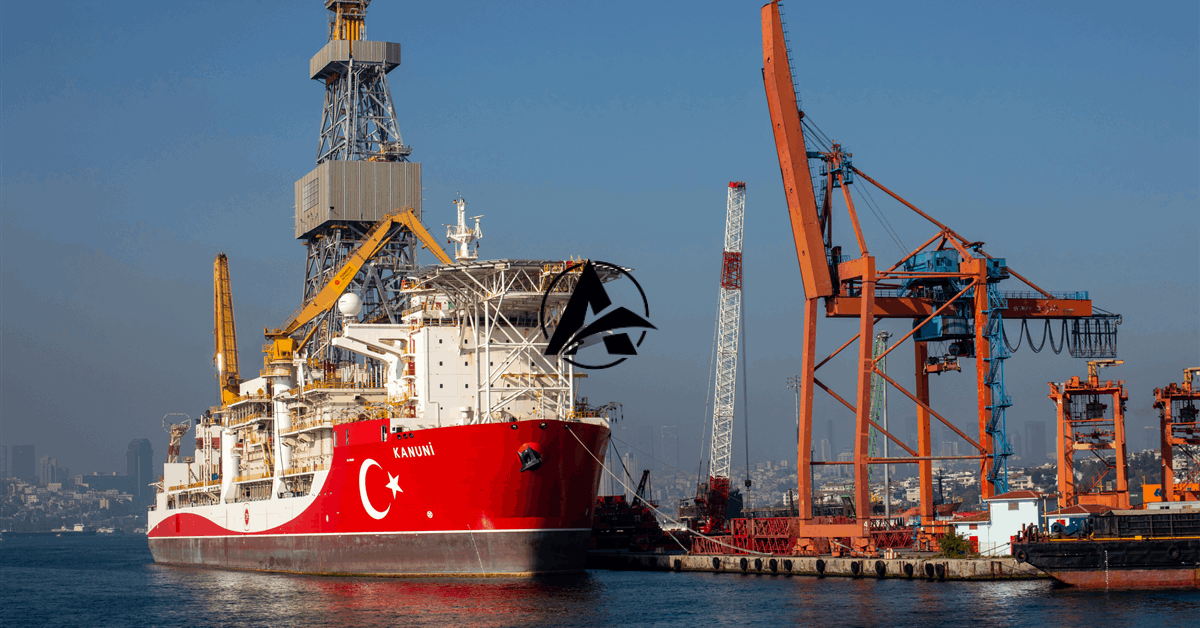

The primary objective behind this large-scale fundraising initiative focuses on increasing Turkey’s energy output. Turkiye Petrolleri intends to use the proceeds to significantly expand its oil and gas production. This expansion aligns with Turkey’s broader energy strategy.

Strategic Growth Initiatives

Expanding oil and gas production remains a key strategic goal for Turkiye Petrolleri. The company seeks to enhance its operational capacity. Furthermore, these investments aim to strengthen Turkey’s energy independence and supply security.

The successful execution of this Sukuk offering could provide a substantial financial foundation. It would support Turkiye Petrolleri’s ambitious production targets. The international market will closely observe the offering’s reception and its subsequent impact on the company’s growth trajectory.

1 Comment