JAPEX is preparing to significantly expand its footprint within the United States. The company announced a substantial $1.3 billion acquisition in the DJ Basin. This strategic move marks a pivotal moment for JAPEX. It will grant the company its first operated stakes in the U.S. market.

Key Acquisition Details

The acquisition involves a significant financial commitment. JAPEX will invest $1.3 billion. This investment targets specific assets located within the DJ Basin. The DJ Basin is a prominent region for energy production in the United States. This deal underscores JAPEX’s dedication to growth in North America.

JAPEX previously focused on shale oil assets in the region. However, these were not operated directly by the company. This new agreement provides JAPEX with direct operational control. It represents a shift in their engagement model.

Strategic Shift in U.S. Operations

This acquisition holds particular importance for JAPEX’s operational strategy. It provides the company with its inaugural operated stakes in the United States. Previously, JAPEX participated in U.S. shale projects. Nevertheless, it did so through non-operating interests.

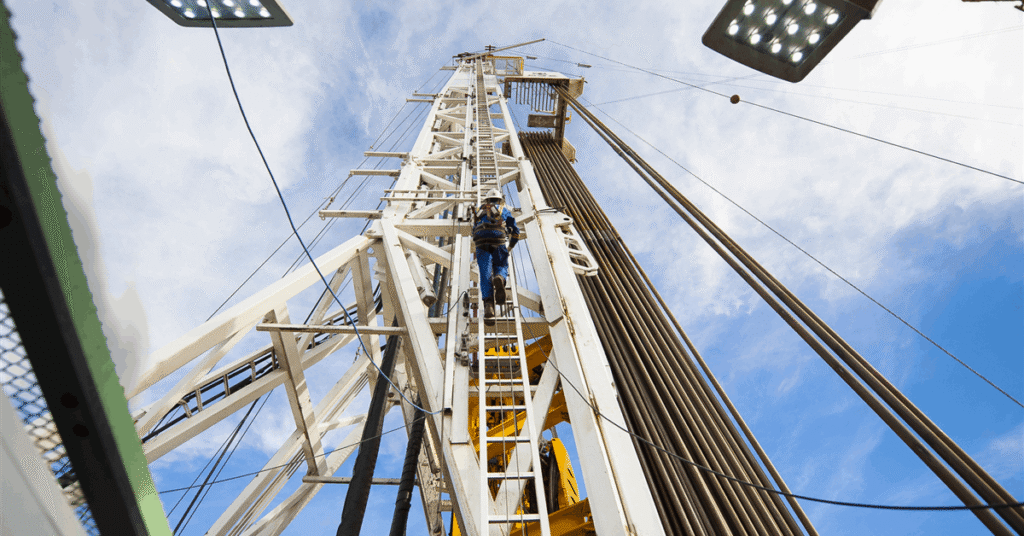

Gaining operated stakes means JAPEX will now manage daily operations. This includes drilling and production activities. Consequently, the company enhances its control over asset development. It also gains greater influence over strategic decisions.

Continued Focus on Shale Oil

JAPEX has consistently maintained a focus on U.S. shale oil. This $1.3 billion acquisition aligns directly with that established strategy. The company deepens its involvement in the shale sector. Furthermore, it strengthens its overall energy portfolio.

The move reinforces JAPEX’s commitment to U.S. energy markets. It positions the company for more direct growth. This investment reflects confidence in the long-term prospects of shale oil production. JAPEX aims to leverage this new operational capacity.

The substantial investment and shift to operated stakes signal JAPEX’s evolving U.S. strategy. This development could reshape its standing in the North American energy landscape. The company now possesses greater direct control over its U.S. assets.

Leave a Comment