Crude oil prices increased today, driven by market expectations of more stringent sanctions against Russia. These heightened anticipations stemmed from robust rhetoric emanating from the European Union. This signals a potential tightening of measures against Moscow.

EU Rhetoric Influences Market Sentiment

Energy traders actively monitor geopolitical developments. They quickly factor potential supply disruptions into their pricing models. The European Union’s strong statements suggested a greater likelihood of reduced Russian oil exports. This prospect typically impacts global oil benchmarks.

Such declarations often lead to immediate market adjustments. Investors anticipate a tighter global supply-demand balance. Consequently, they bid up prices for crude oil futures. This reflects the perceived risk of future supply constraints.

Anticipating Supply Shifts

Tighter sanctions on Russia could restrict its ability to sell oil on international markets. Russia is a major global oil producer. Any significant reduction in its output available to the market can exert upward pressure on prices. This mechanism directly links political action to commodity values.

Impact on Futures Contracts

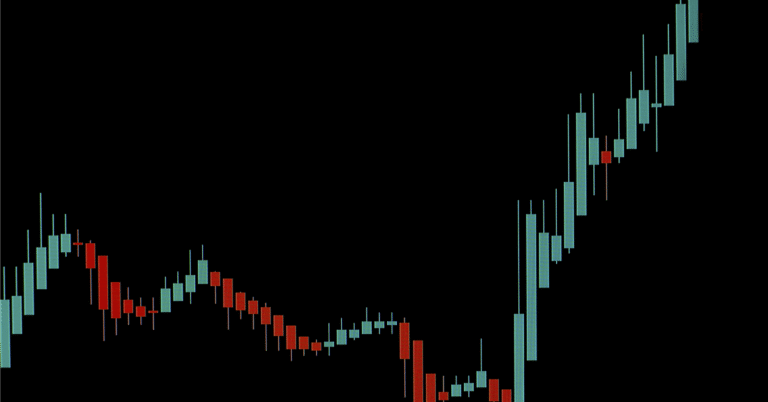

Futures contracts for both Brent crude and West Texas Intermediate (WTI) reacted to the news. These contracts serve as key indicators of future oil prices. Their upward movement reflects collective market belief in impending supply challenges.

The current price gains highlight the market’s sensitivity. Geopolitical tensions, particularly those involving major energy producers, remain a primary driver. Traders will continue watching EU announcements closely for further direction.

2 Comments