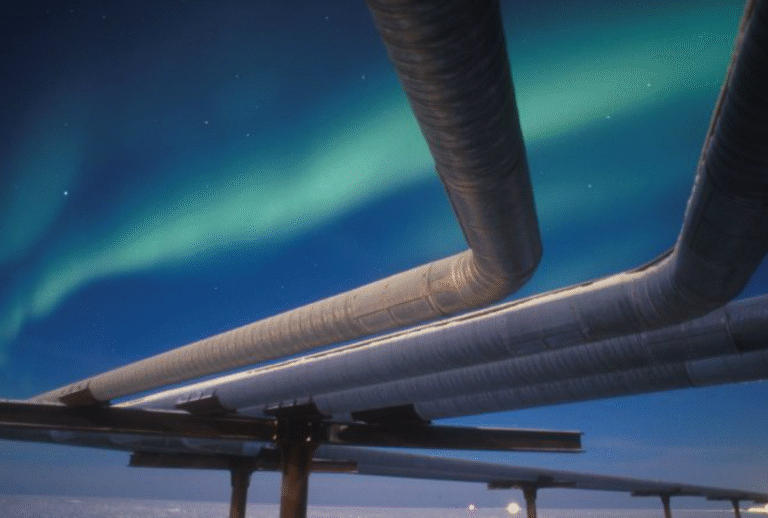

Crude oil prices concluded recent trading sessions with an upward trajectory. This gain occurred despite Saudi Arabia’s recent decision to implement a price reduction. Market analysts attribute this movement largely to persistent geopolitical tensions.

Geopolitical Tensions Drive Market

The ongoing conflict between Russia and Ukraine continues to exert significant influence on global energy markets. Investors closely monitor developments in the region. The broader geopolitical landscape plays a critical role in oil price fluctuations.

Stalled Peace Efforts

Reports indicate that peace talks aimed at resolving the Russia-Ukraine conflict have stalled. These negotiations have failed to achieve a breakthrough. Consequently, hopes for a swift resolution to the conflict diminish.

Sanctions Remain in Place

The lack of progress in peace discussions ensures that international sanctions against Russia remain active. These measures target Russia’s economy, including its energy sector. The sanctions effectively limit Russia’s ability to supply oil to global markets. This sustained restriction provides crucial support to oil futures prices.

Saudi Arabia’s Pricing Strategy

Saudi Arabia recently announced a cut in its official selling prices. This move typically signals an intent to capture greater market share or respond to perceived demand weakness. However, the market’s reaction suggests other factors held greater sway. The geopolitical situation overshadowed Saudi Arabia’s pricing adjustments.

Ultimately, the prevailing geopolitical climate, particularly the ongoing Russia-Ukraine conflict and associated sanctions, proved to be the dominant force. It propelled crude oil prices higher. This occurred even as Saudi Arabia sought to influence the market with its own price cuts.

Leave a Comment