Italian state-backed energy company Eni has entered into an agreement to acquire a substantial portfolio of operational renewable energy assets in France. The deal involves approximately 760 megawatts (MW) of projects currently generating power across various locations in the country. Paris-based Neoen, a prominent renewable energy developer, stands as the seller in this transaction.

Details of the Acquisition

Operational Portfolio

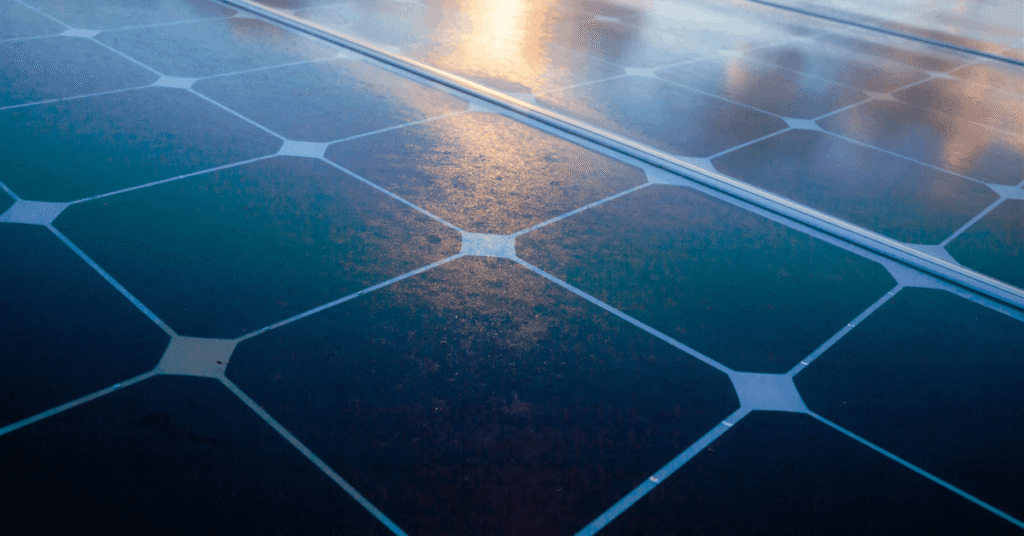

The acquired assets consist entirely of renewable energy projects already generating power. This ensures immediate contribution to Eni’s energy portfolio upon completion of the deal. These projects represent a significant addition of green energy capacity.

Capacity and Geographical Scope

The portfolio holds a combined capacity of approximately 760 MW. These projects are strategically located across France, contributing to the nation’s energy mix. The diverse geographical spread enhances the resilience and output stability of the acquired assets.

The Companies Involved

Eni’s Strategic Move

Eni, a major Italian energy player with significant state backing, executes this acquisition. This move aligns with broader industry trends towards decarbonization and expanding renewable energy footprints. The company strengthens its presence in the European renewable sector.

Neoen’s Divestment

Neoen, headquartered in Paris, operates as a leading independent producer of renewable energy. It develops, finances, builds, and operates power plants. The company divests these operational assets, transferring them to Eni’s ownership.

This agreement underscores the ongoing consolidation and growth within the European renewable energy market. Eni’s acquisition of Neoen’s operational French assets marks a notable development for both companies and the broader energy landscape.

3 Comments