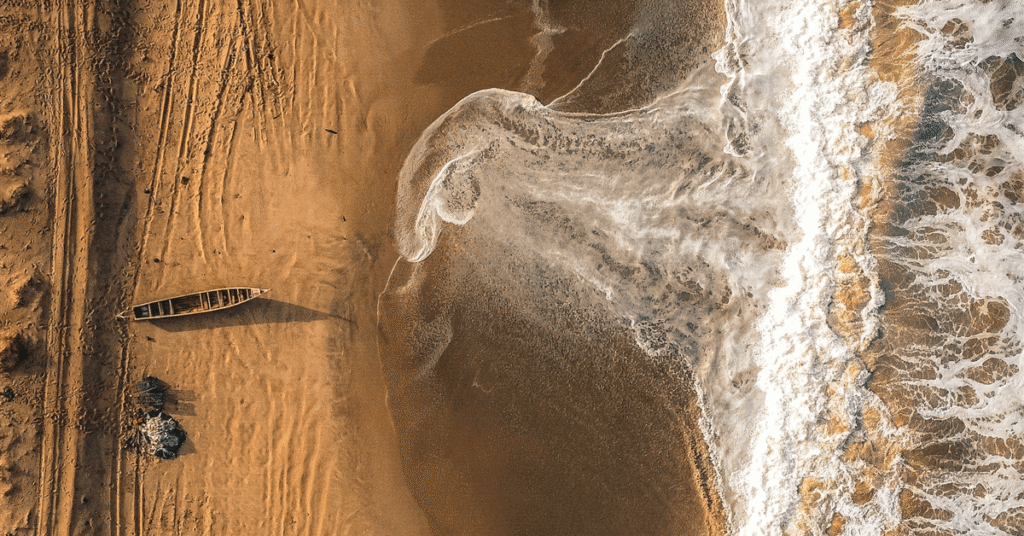

Antler has announced plans to divest a 40 percent interest in one of its oil and gas exploration blocks. This significant block is situated offshore Equatorial Guinea. Fuhai will acquire this substantial stake. The transaction marks a key development for Antler’s operational strategy in the region.

The Divestment Agreement

Under the terms of the farm-out agreement, Antler will transfer a 40 percent non-operating interest to Fuhai. This move restructures the ownership landscape of the Equatorial Guinean asset. Following the completion of the transaction, Antler will maintain a 40 percent operating stake in the block. This ensures its continued leadership in exploration and development activities.

Antler’s Retained Operating Role

Antler’s decision to retain a 40 percent operating interest underscores its commitment to the block. The company will continue to manage daily operations and strategic decisions. This arrangement allows Antler to leverage Fuhai’s investment while maintaining direct control over project execution.

Strategic Funding for Exploration

The primary objective behind this divestment is to secure necessary funding. Antler plans to utilize these new financial resources to advance its exploration programs. Such farm-out agreements are common industry practices. They help companies finance capital-intensive drilling campaigns and mitigate financial risks.

Focus on Barracuda Prospect

Specifically, Antler will allocate the entirety of the secured funding towards drilling the Barracuda prospect. This prospect represents a high-priority target within their exploration portfolio. Drilling the Barracuda prospect is a critical step. It could potentially unlock significant hydrocarbon reserves in the area.

This strategic transaction positions Antler to progress its key exploration initiatives. It also brings a new partner, Fuhai, into the Equatorial Guinean block. Both companies anticipate positive outcomes from this collaborative venture.

Leave a Comment