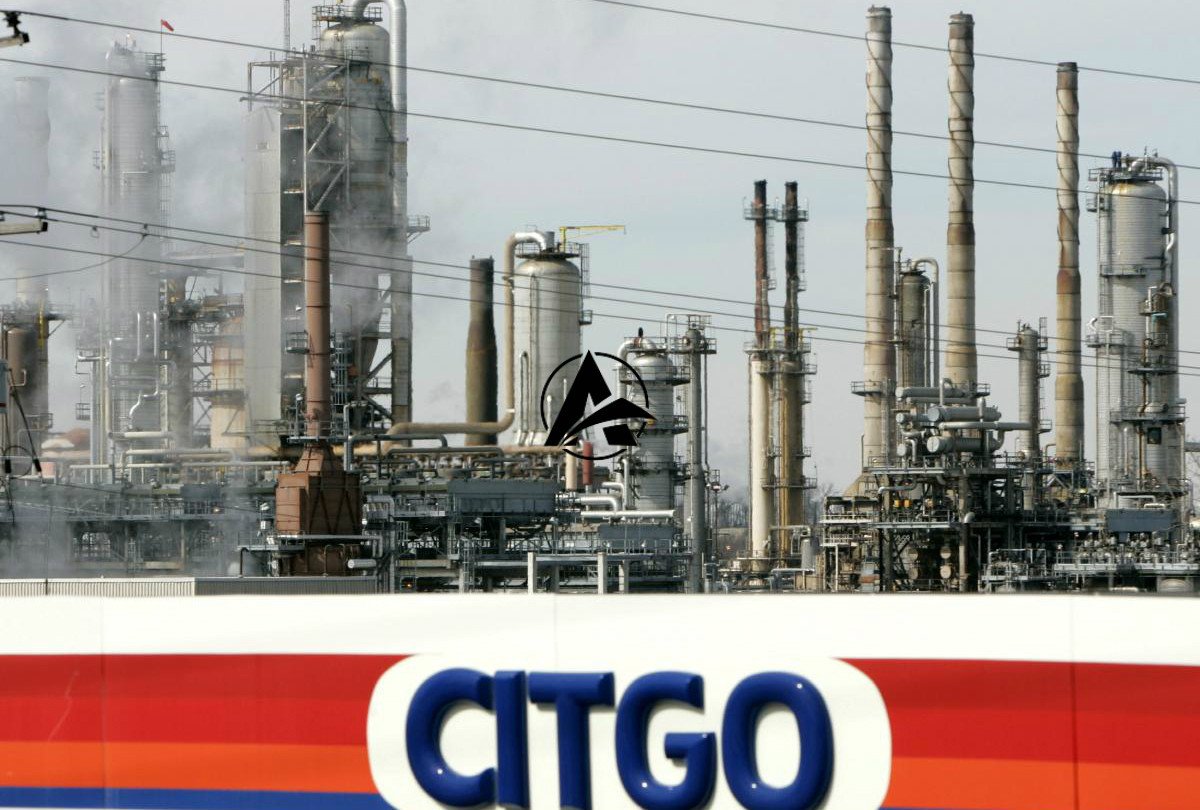

Amber Energy, an affiliate of Elliott Investment Management, announced its plan to acquire and retain Citgo Petroleum‘s refineries, terminals, and other assets. This strategic decision underscores Amber Energy’s intent to integrate Citgo’s operations fully into its portfolio. The move signals a long-term commitment to the energy sector.

Strategic Asset Retention

The core motivation behind Amber Energy’s decision to keep Citgo’s refineries centers on their consistent and stable earnings. These assets reliably generate financial returns throughout the year. This stability provides a strong foundation for future operational strategies.

Refineries as Core Value

Citgo’s refining capabilities represent a significant value proposition for Amber Energy. Their continuous output ensures a steady revenue stream. This consistent performance was a key factor in the acquisition strategy.

Regulatory Approvals and Timeline

The acquisition expects to finalize in 2026. However, it requires crucial approval from the U.S. Treasury’s Office of Foreign Assets Control (OFAC). This regulatory clearance remains a necessary step before the deal can officially close.

Anticipated Post-Acquisition Changes

Following the takeover, Amber Energy plans to implement significant operational and structural changes within Citgo. These adjustments aim to optimize performance and align Citgo with Amber Energy’s broader objectives.

Board and Staff Adjustments

Amber Energy expects to restructure Citgo’s board of directors. This shake-up will likely bring new leadership perspectives to the company. In addition, the firm may convert some current contractors to permanent employee status, enhancing workforce stability and integration.

Leave a Comment