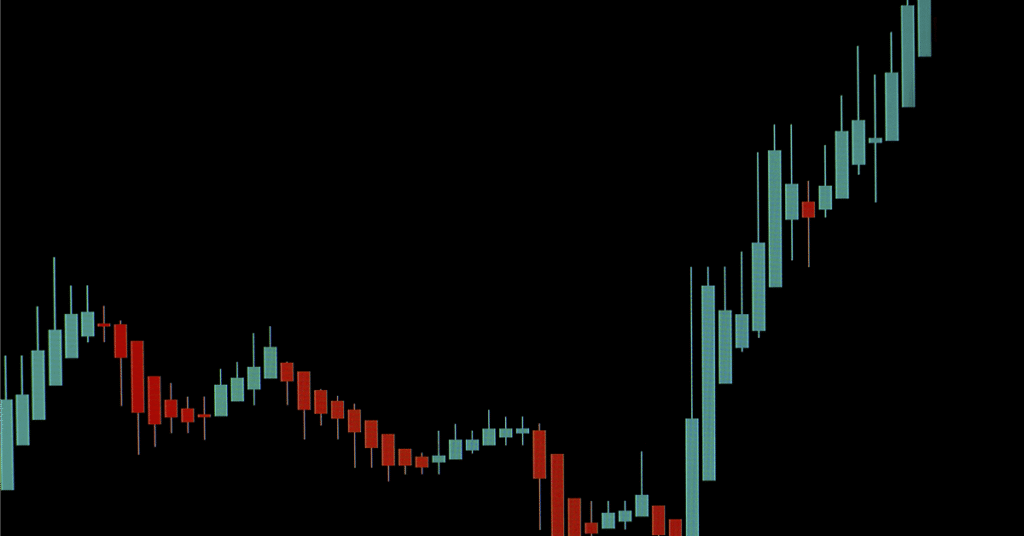

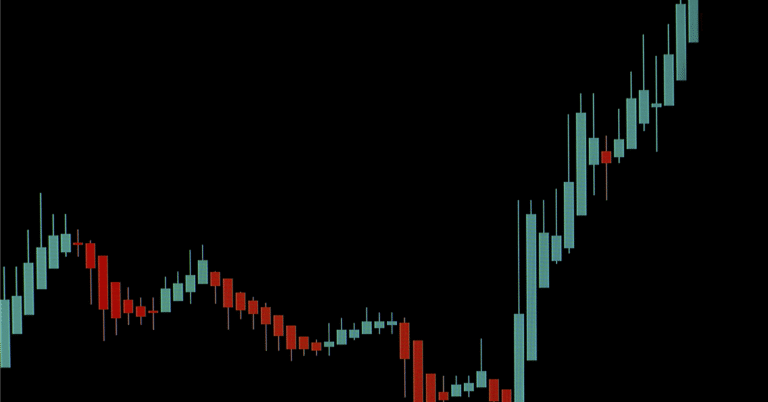

Global crude oil prices recently climbed. This rise stemmed from market expectations for tighter EU sanctions on Russia. Strong rhetoric from EU officials fueled these expectations. These statements signaled potential new economic penalties against Russia. Russia remains a major global oil producer.

Market Response to Geopolitical Tensions

Investors promptly reacted to the evolving geopolitical landscape. Threats to global oil supply typically impact markets. Tighter sanctions could reduce the availability of Russian crude. This situation creates supply concerns. Consequently, prices often rise. They anticipate future disruptions.

The current price increase reflects this forward-looking sentiment. Participants price in future supply constraints. Geopolitical developments frequently influence commodity values. Oil prices show particular sensitivity to these factors.

EU’s Stance on Economic Measures

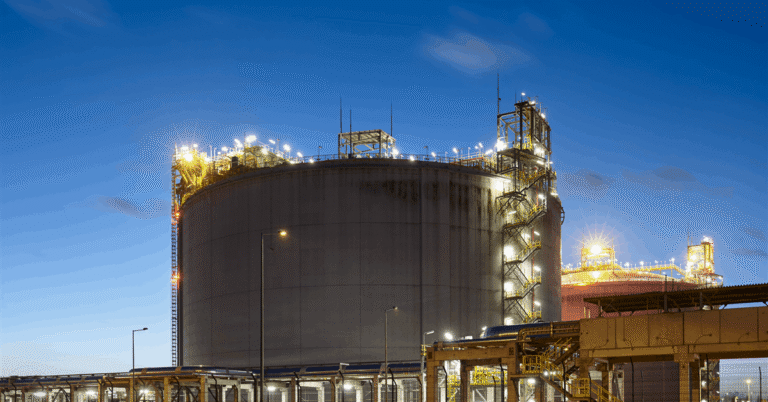

European Union officials have adopted a firmer tone. Their public statements suggest a strong resolve for further action. EU discussions focus on increasing economic pressure. The bloc aims to restrict Russia’s financial resources. Energy exports provide major Russian revenue. Thus, sanctions targeting this sector carry significant weight.

These measures seek to limit Russia’s ability to fund its operations. Penalties aim for maximum economic impact. The EU continues to explore various options. Member states debate the scope and timing of new sanctions. Final decisions await ongoing negotiations.

The global energy market will monitor these developments closely. Future EU announcements could significantly influence crude price trends. Geopolitical factors remain critical drivers for oil trade.

Leave a Comment