Crude oil prices experienced a decline recently. This movement occurred as a Russian port resumed its operational activities. The reopening of this crucial maritime facility took place despite ongoing broader geopolitical tensions.

Market Response

The fall in oil prices reflects immediate market reactions. Traders often monitor supply-side developments closely. Any factor suggesting an increase in global supply can influence pricing. Consequently, this recent port activity likely signaled a potential easing of supply constraints.

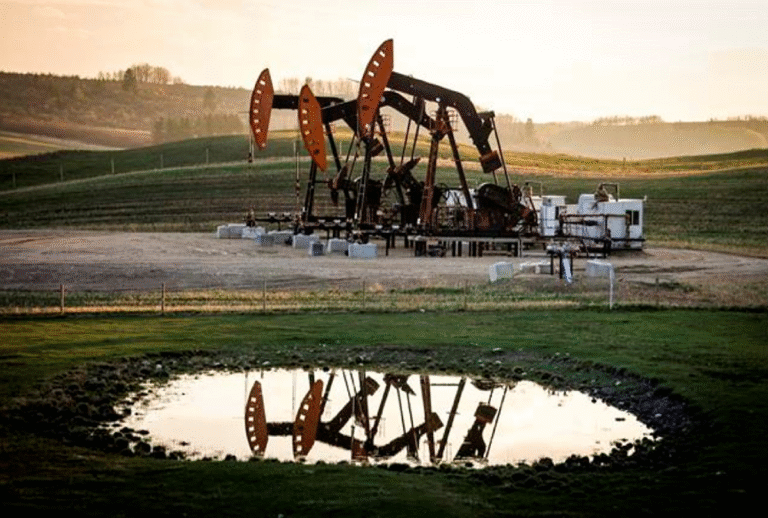

Russian Port Operations Resume

A key Russian port recommenced its operations. This resumption means crude oil and other commodities can once again move through the facility. Such maritime infrastructure plays a vital role in global energy markets. Its activity directly impacts the flow of goods from the region.

Supply Chain Impact

The return to full operation at the port helps facilitate exports. This directly contributes to the overall global supply of crude oil. Increased availability often puts downward pressure on prices. Market participants assess these developments for their potential impact on future supply.

Geopolitical Context

The reopening transpired amid persistent wider geopolitical tensions. These tensions continue to shape international trade and energy policies. Despite the challenging environment, port activities have resumed. This illustrates the complex interplay between geopolitics and commodity markets.

The market absorbed news of the port’s return to service. This development provided a clear signal to traders. Oil prices responded accordingly, moving lower. The situation highlights how logistical factors can influence global commodity valuations, even amidst wider international complexities.

1 Comment