Meren, a Canadian company actively involved in African operations, recently announced an increase in its production guidance. This update follows the company’s robust third-quarter performance. During this period, Meren reported an average production of 35,600 barrels of oil equivalent per day (boepd).

Third-Quarter Performance Highlights

The company demonstrated strong operational efficiency in the third quarter. Meren’s African assets delivered a daily output of 35,600 boepd. This robust production figure underpins the revised guidance. Consequently, the firm now anticipates higher future output.

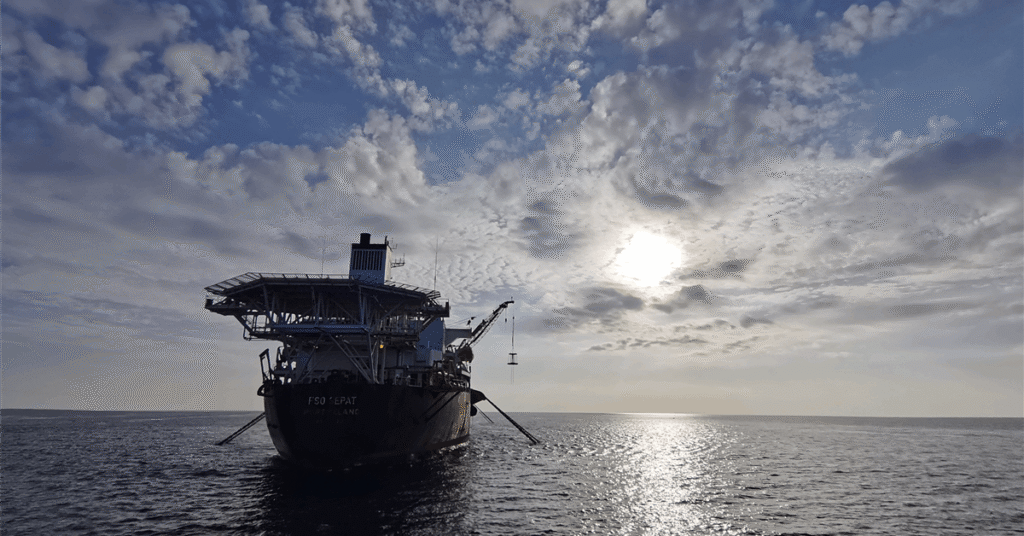

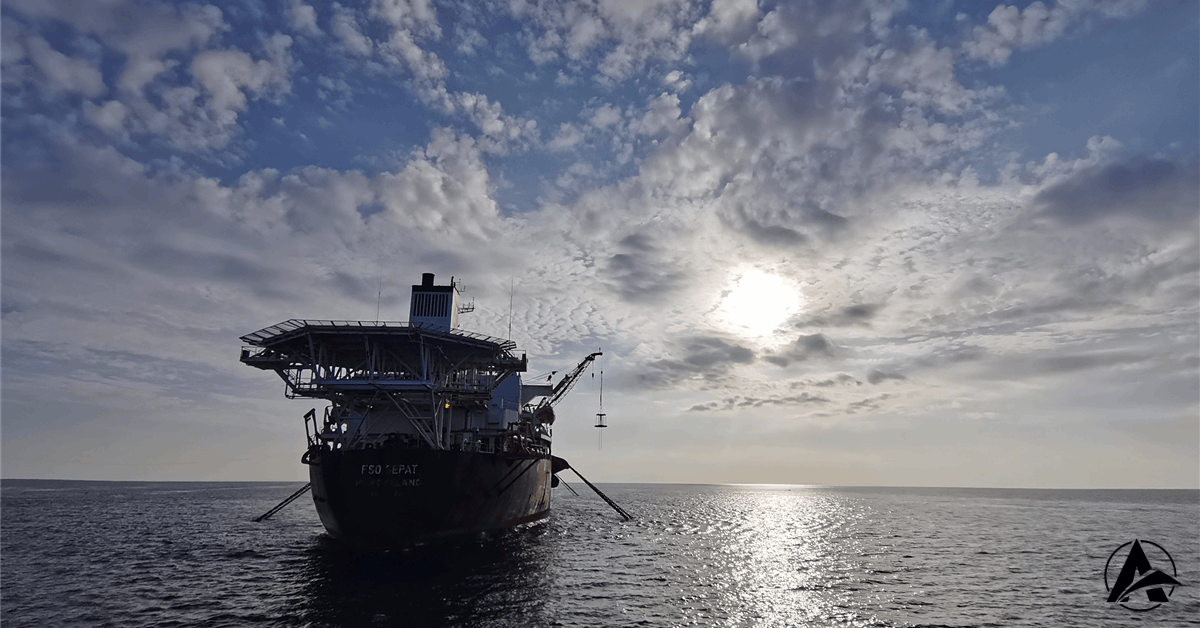

Operational Success in Africa

Meren’s primary exploration and production activities take place across various African regions. This geographic focus remains a core aspect of its business model. The company continues to leverage its expertise in these markets. Its successful Q3 results reflect effective resource management.

Revised Production Outlook

Following the positive Q3 figures, Meren has adjusted its overall production targets upward. This decision directly reflects the firm’s confidence in its operational capabilities. The increased guidance signals an optimistic trajectory for the company’s future.

Strategic Implications

The upward revision suggests Meren expects sustained performance. It indicates continued efficiency from its existing assets. Furthermore, the company likely foresees opportunities for incremental growth. This strategic move positions Meren for potential expansion.

Company Overview

Meren maintains its corporate headquarters in Canada. However, its significant operational footprint lies in Africa. This dual identity shapes its market approach. The company focuses on maximizing value from its energy assets.

1 Comment