Western Midstream (WES) has finalized new agreements with energy companies Occidental and ConocoPhillips. These arrangements represent a strategic step for the Woodlands, Texas-based company. They advance its transition towards fixed-fee structures for operations within a maturing basin. This significant move reshapes WES’s business model.

New Agreements and Strategic Shift

The company confirmed these new deals. They mark a crucial advancement in WES’s operational strategy. Historically, midstream operations often faced fluctuations tied to commodity prices. These new contracts aim to mitigate such volatility. WES seeks to establish a more stable revenue stream.

Fixed-Fee Structures

A key aspect of these agreements involves fixed-fee arrangements. Under this model, WES receives a consistent payment for its services. This occurs regardless of commodity price swings. This structure helps ensure predictable cash flows for the company. It provides financial stability in the long term.

Implications for Western Midstream

This transition is particularly relevant for operations within a maturing basin. Such basins typically see less new drilling activity. Consequently, they emphasize existing infrastructure. Fixed-fee contracts offer a stable foundation in this environment. They support sustained profitability for WES. The company reduces its exposure to market unpredictability.

The shift also signals WES’s commitment to a robust financial framework. It demonstrates a proactive approach to market changes. Management believes this strategy will enhance shareholder value. Furthermore, it strengthens WES’s position within the midstream sector.

Company Profile

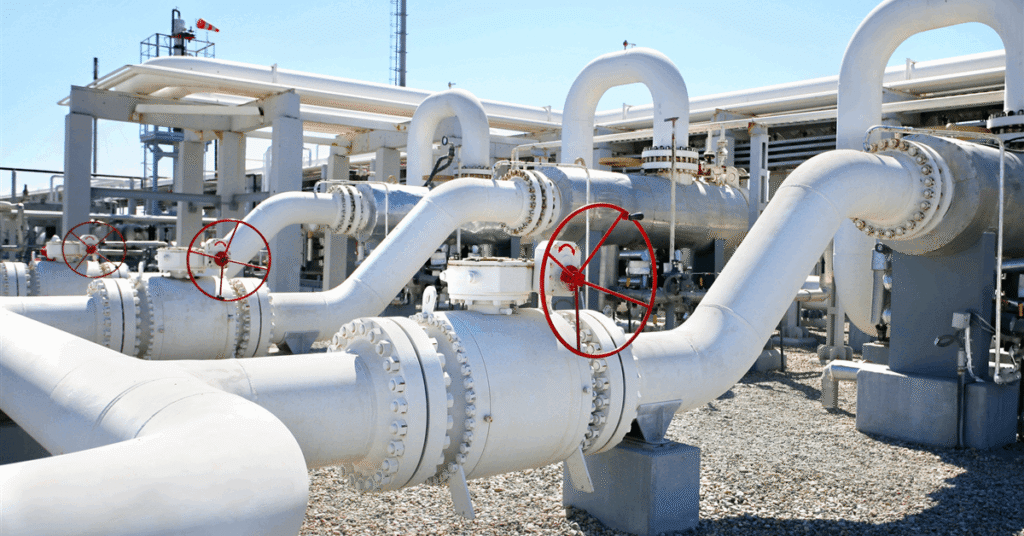

Western Midstream bases its headquarters in The Woodlands, Texas. It operates extensive pipeline and processing infrastructure. The company provides essential services to energy producers. Its partnerships with major players like Occidental and ConocoPhillips underscore its industry significance.

Leave a Comment