The United States recently approved the first sale of Venezuelan crude oil. This action signals a notable shift towards energy pragmatism in the Western Hemisphere. Venezuelan oil barrels are now preparing to re-enter global markets. Energy producers, refiners, and importers across the Caribbean and Latin America anticipate significant impacts on supply security, logistical operations, and regional investment dynamics.

Policy Shift Underway

Washington’s decision marks a significant policy adjustment. This U.S.-approved sale of Venezuelan crude is the first of its kind. It reflects a broader strategic reevaluation of regional energy policies, potentially redefining regional energy relationships.

Anticipated Market Impacts

The reintroduction of Venezuelan crude will likely cause widespread effects. Stakeholders in Caribbean and Latin American energy sectors are closely monitoring developments. They prepare for shifts in supply security, logistics, and regional investment patterns.

Supply Security Reconfiguration

Venezuelan oil’s return offers new supply options. Its re-entry could diversify regional energy sources, enhancing overall supply security for some importers. Conversely, existing suppliers may face increased competition.

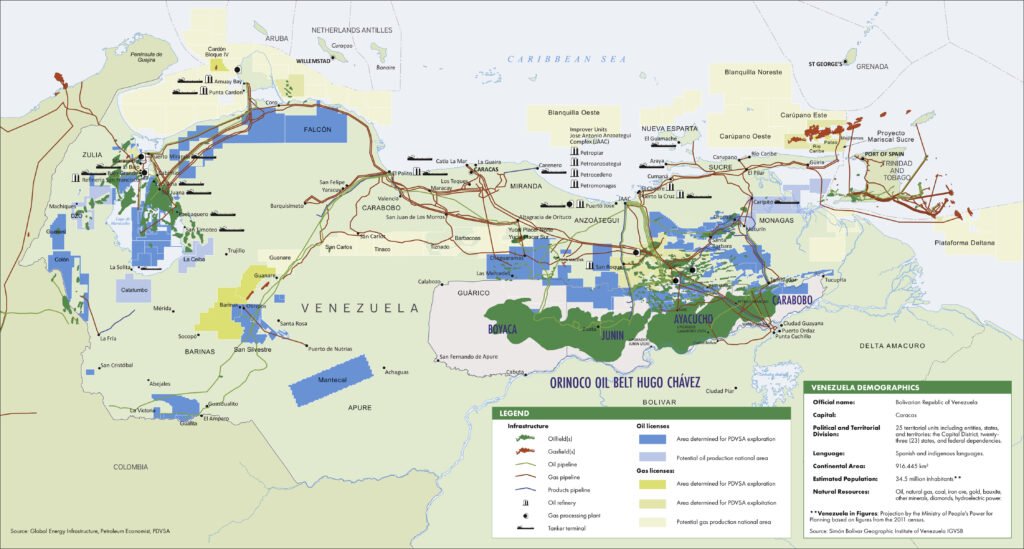

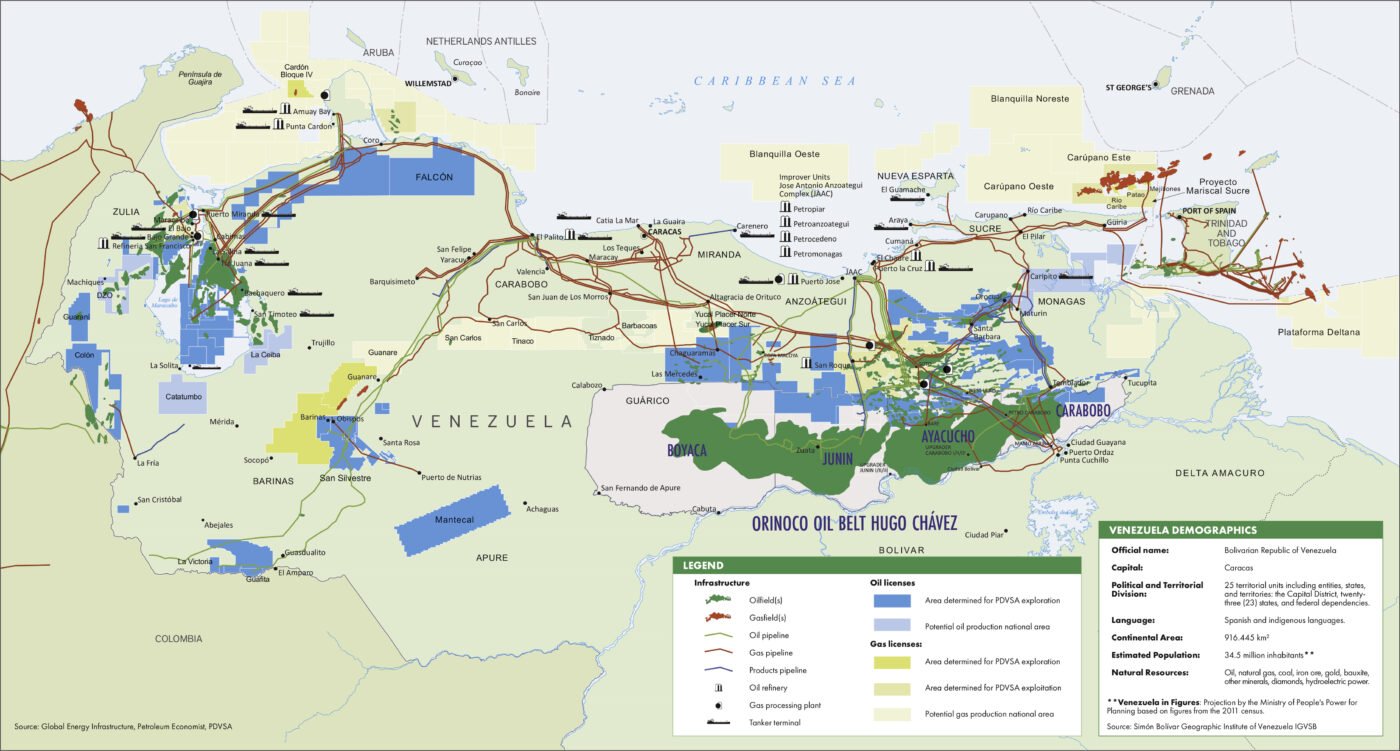

Logistical Operations and Infrastructure

Moving Venezuelan crude requires robust logistical frameworks. Refiners and importers will need to adapt operations. Port facilities and shipping routes might experience increased activity, creating opportunities and challenges for regional infrastructure.

Shifting Investment Dynamics

Capital flows across the energy sector could realign. New investment opportunities may emerge in exploration or refining. Investors will likely reassess risks and returns, impacting funding levels for regional energy projects.

The U.S. approval of Venezuelan crude sales represents a pivotal moment. It signals a strategic reorientation in regional energy policy. Market participants are preparing for a period of adjustment and adaptation.

Leave a Comment