Shell plc reported adjusted earnings of $5.4 billion for the third quarter of 2025. The company also announced cash flow from operations totaling $12.2 billion for the same period. This strong financial performance highlights a positive quarter for the global energy firm.

Key Drivers of Performance

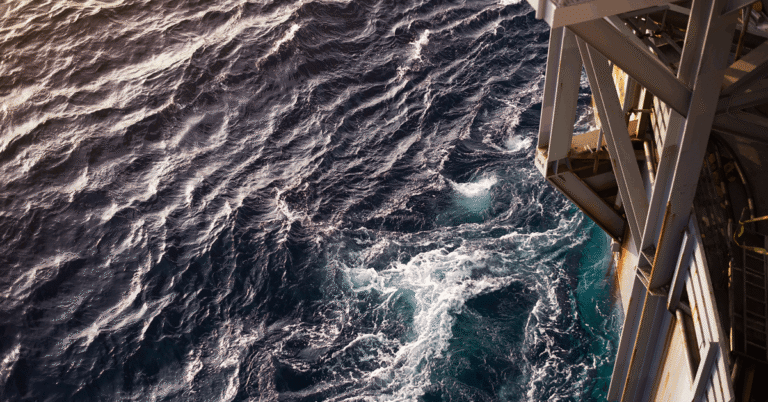

Several factors underpinned Shell’s robust financial results. Record production from its deepwater assets played a significant role. The company operates these key assets in Brazil and the Gulf of America. Their output reached unprecedented levels during the quarter, directly contributing to the earnings increase.

Deepwater Asset Contributions

Deepwater operations represent a strategic focus for Shell. High production volumes from these complex projects demonstrate operational efficiency. This consistent output helps secure a stable supply of resources. It also supports the company’s overall energy portfolio.

Robust LNG Trading Results

Shell’s liquefied natural gas (LNG) trading operations delivered strong performance. These results further bolstered the company’s adjusted earnings. Global demand for LNG continues to influence market dynamics. Shell’s trading capabilities capitalized on these conditions effectively.

Global LNG Market Influence

The strength in LNG trading reflects a responsive market strategy. Shell actively manages its global LNG portfolio. This approach allows the company to optimize its trading positions. Consequently, it captures value from fluctuating energy prices and regional demand shifts.

1 Comment