Oil prices recently experienced a decline. Market participants shifted their primary focus. Traders moved past geopolitical developments. Instead, they concentrated on the growing global surplus of crude oil. This change in attention significantly impacted market sentiment.

Shifting Market Focus

The global oil market demonstrated a notable change in priorities. Investors and analysts previously monitored geopolitical tensions closely. These tensions often influence supply stability. However, the market now directs its attention elsewhere. Participants increasingly emphasize fundamental supply and demand metrics. This fundamental shift altered pricing dynamics for crude.

Geopolitical Factors Recede

For some time, geopolitical events frequently drove oil price fluctuations. Conflicts or political instability in major producing regions often raised supply concerns. Such worries typically pushed prices higher. Current market conditions suggest a different trend. Traders now perceive these geopolitical risks as less immediate. Their influence on daily trading decisions has diminished considerably.

Global Supply Dynamics

A significant factor contributing to the price drop is the expanding worldwide crude oil surplus. Robust production levels from various oil-exporting nations play a role. Additionally, some analysts point to potentially weaker global demand forecasts. These combined factors create an environment of ample supply, which the market perceives as a persistent trend.

Impact of Oversupply

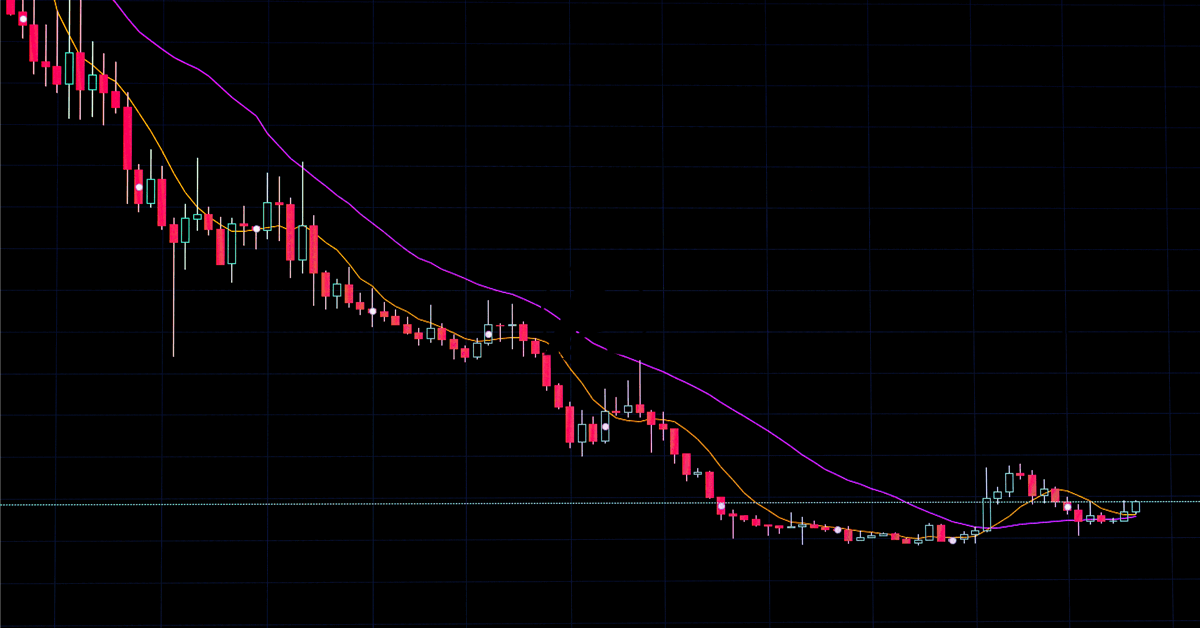

An excess of oil in storage or readily available often pressures prices downward. When supply outstrips demand, sellers compete more aggressively, which typically results in lower bids. The current surplus situation reflects this economic principle. Consequently, the market adjusted its pricing expectations, directly leading to the recent decline in crude oil values.

The recent fall in oil prices underscores a fundamental shift in market priorities. Traders have clearly moved away from geopolitical concerns. Instead, they now focus intensely on the tangible reality of a growing global oil surplus. This re-evaluation of market drivers dictates current pricing trends.

Leave a Comment