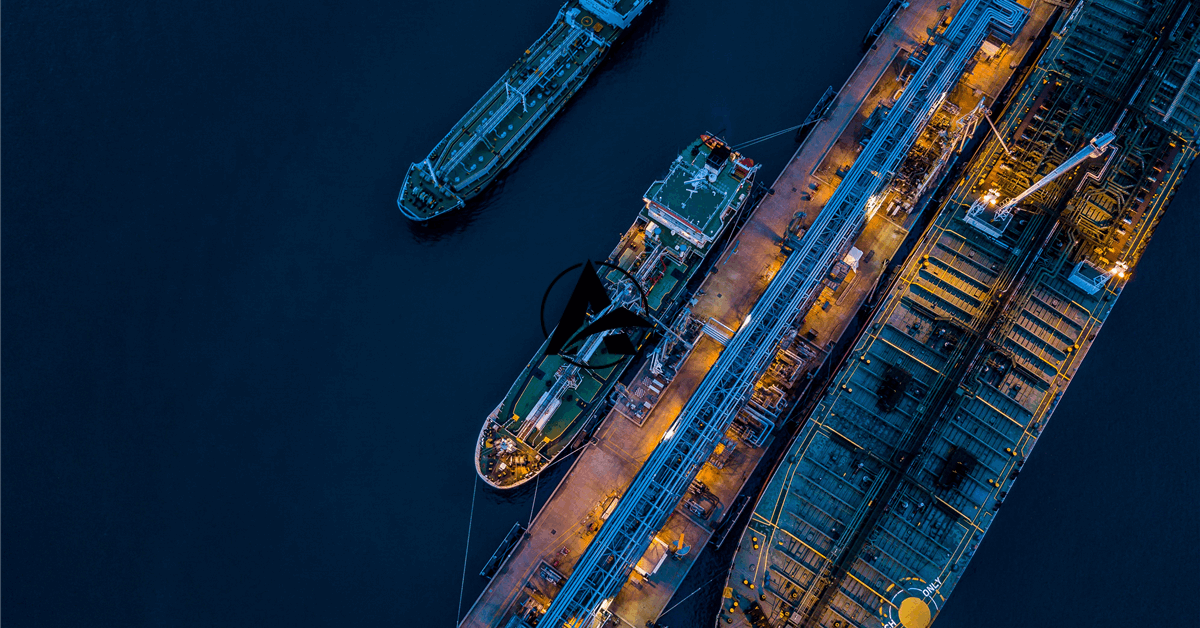

Hafnia has finalized its acquisition of a significant stake in TORM. The company completed the purchase of nearly 14 percent of TORM from Oaktree Capital. Hafnia valued the transaction at $311.43 million.

Transaction Overview

The deal saw Hafnia acquire a substantial portion of TORM’s shares. Specifically, the stake represents nearly 14 percent of the company. The financial consideration for this acquisition amounted to $311.43 million. This marks a considerable investment by Hafnia.

Involved Parties

Hafnia’s Strategic Move

Hafnia acted as the buyer in this transaction. This strategic purchase expands its portfolio within the shipping sector. The company successfully completed the acquisition, reinforcing its market position.

Oaktree Capital’s Divestment

Oaktree Capital served as the seller in the deal. They divested their nearly 14 percent holding in TORM. The sale generated $311.43 million for Oaktree Capital, concluding their investment in the shipping firm.

Market Implications

This acquisition highlights ongoing activity within the maritime industry. Hafnia’s move demonstrates its investment strategy and commitment to growth. The transaction concludes a notable period for both companies involved, reshaping ownership in TORM.

Leave a Comment