Chevron has acquired a 40% stake in two offshore Nigerian licenses from TotalEnergies. These licenses, PPL 2000 and PPL 2001, represent a significant development. A farmout agreement facilitated this transaction. This move marks an important shift in the region’s energy landscape.

The Farmout Agreement and Partnership

This transaction expands an existing global exploration partnership between TotalEnergies and Chevron. TotalEnergies transferred the 40% stake to Chevron. This farmout agreement deepens their collaboration. Both companies have a history of working together on various projects.

Expanding Global Partnership

The current deal specifically targets the Nigerian offshore assets. It reinforces a broader strategy. Both energy giants aim to optimize their worldwide exploration portfolios. This strategic alignment drives their joint ventures.

Strategic Implications for the West Delta Basin

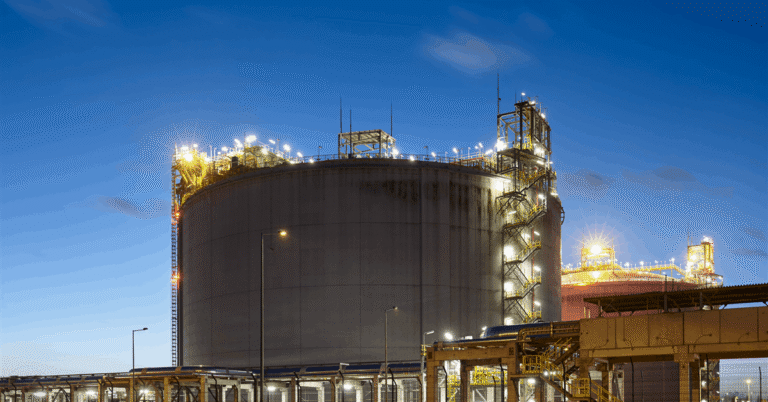

The joint venture will significantly strengthen both companies’ operational positions. This applies particularly within Nigeria’s West Delta basin. The region holds considerable importance for offshore oil and gas exploration. Access to these blocks enhances their long-term prospects.

Strengthening Market Position

Chevron gains a substantial interest in promising offshore acreage. TotalEnergies also benefits from the partnership. They share the investment risks and operational responsibilities. This collaborative approach can lead to more efficient resource development.

Regulatory Process Underway

The agreement is currently progressing through necessary regulatory approvals. Authorities will review the terms of the farmout. Finalization of the deal depends on these assessments. Both companies anticipate a smooth approval process.

Leave a Comment