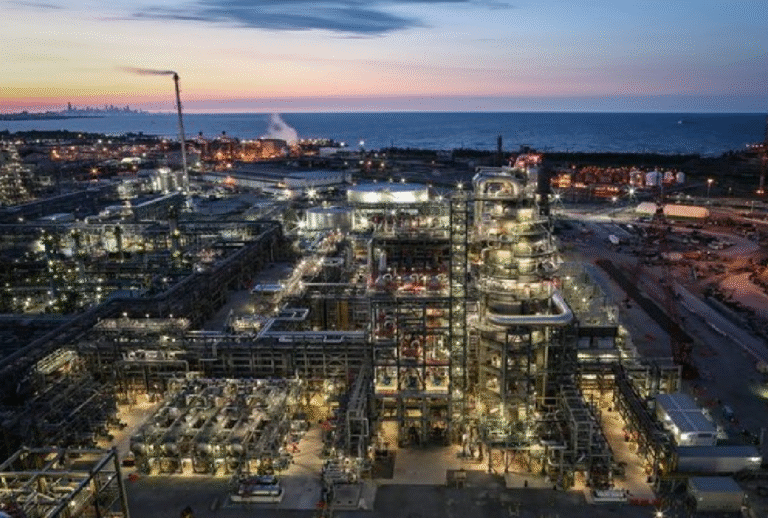

Oil prices recently experienced an uptick, moving higher in tandem with global stock markets. This recent rise signifies a rebound for crude oil, which had previously fallen to a one-month low. The concurrent movement across these key markets indicates a broader shift in investor sentiment.

Crude Oil Rebounds from Low

Crude oil benchmarks demonstrated an upward trajectory. This increase followed a period where prices had reached their lowest point in a month. The rebound suggests market participants found new buying opportunities after the recent decline. Observers note this movement closely.

The commodity’s recent performance represents a shift from previous bearish sentiment. Oil’s recovery from a one-month low indicates a potential stabilization. Market activity reflected this renewed interest among traders.

Global Equities Climb

Global stock markets also recorded gains, mirroring oil’s upward movement. Equities across various regions saw increases throughout the trading day. This broad-based rally contributed to an overall positive market environment. Many investors welcomed the upward trend.

Broader Market Strength

The widespread nature of the equity market gains suggests a general improvement in investor confidence. Major indices participated in the rally. Analysts often view such broad movements as indicators of underlying economic sentiment. This positive momentum affected several sectors.

Intermarket Dynamics at Play

The simultaneous rise in both oil prices and global equities highlights a common trend. These markets often move together, reflecting shared perceptions about economic health. An improving outlook typically supports both commodity demand and corporate earnings. Consequently, their synchronized climb attracted attention.

This correlation suggests that similar factors influence both asset classes. Investors frequently monitor such intermarket relationships for insights into broader economic conditions. The recent movements provide a snapshot of current market dynamics. Market participants observed this pattern closely.

Leave a Comment