Oil prices concluded the trading day higher, occurring amidst a broader rally across equity markets. This upward movement signals a dynamic period for financial markets, reflecting robust investor activity.

Market Anticipation

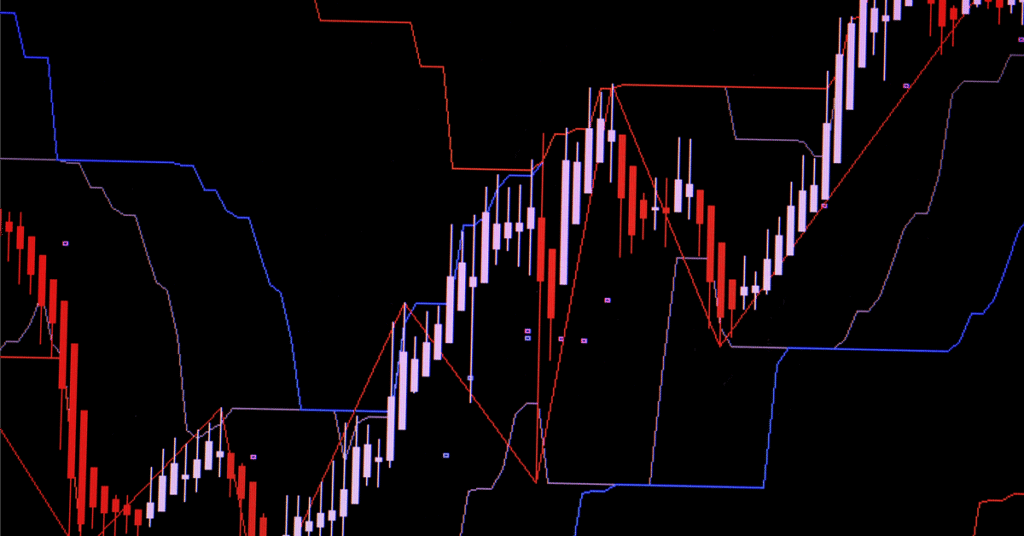

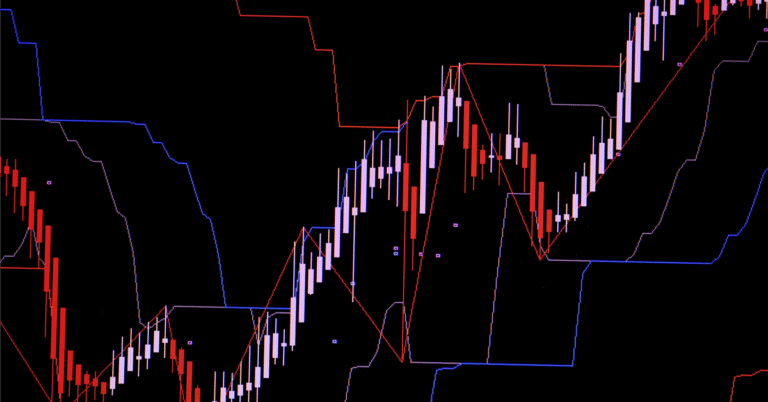

Market participants anticipate volatile trading conditions ahead. This choppiness will likely characterize the period leading up to the upcoming holidays. Traders are actively adjusting their strategies for potential fluctuations as the year-end approaches.

Pre-Holiday Volatility Factors

The pre-holiday period often sees reduced trading volumes. Such conditions can amplify price swings. Consequently, investors watch closely for market signals before the end-of-year breaks. They make cautious decisions.

Geopolitical Influence

Ongoing peace discussions significantly influence current market sentiment. Reports indicate progress in these negotiations. However, significant uncertainty still characterizes the overall situation. This lack of clarity impacts investor decisions across various asset classes.

Uncertainty in Negotiations

Despite advancements, the precise outcomes of the peace discussions remain unclear. This persistent uncertainty contributes to market caution. Analysts continue to monitor developments closely, seeking any definitive breakthroughs or setbacks in the talks.

Rising energy prices, a broader equity rally, and anticipated pre-holiday volatility combine. This underscores a complex market landscape. Geopolitical developments, particularly the evolving peace talks, will continue to shape investor outlooks in the near term.

Leave a Comment